Does Vermont Have An Income Tax . vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. use our income tax calculator to find out what your take home pay will be in vermont for the tax year. taxable income is defined in 32 v.s.a. Property taxes are high when compared. the vermont income tax. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard.

from www.templateroller.com

income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. Property taxes are high when compared. taxable income is defined in 32 v.s.a. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. use our income tax calculator to find out what your take home pay will be in vermont for the tax year. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. the vermont income tax. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and.

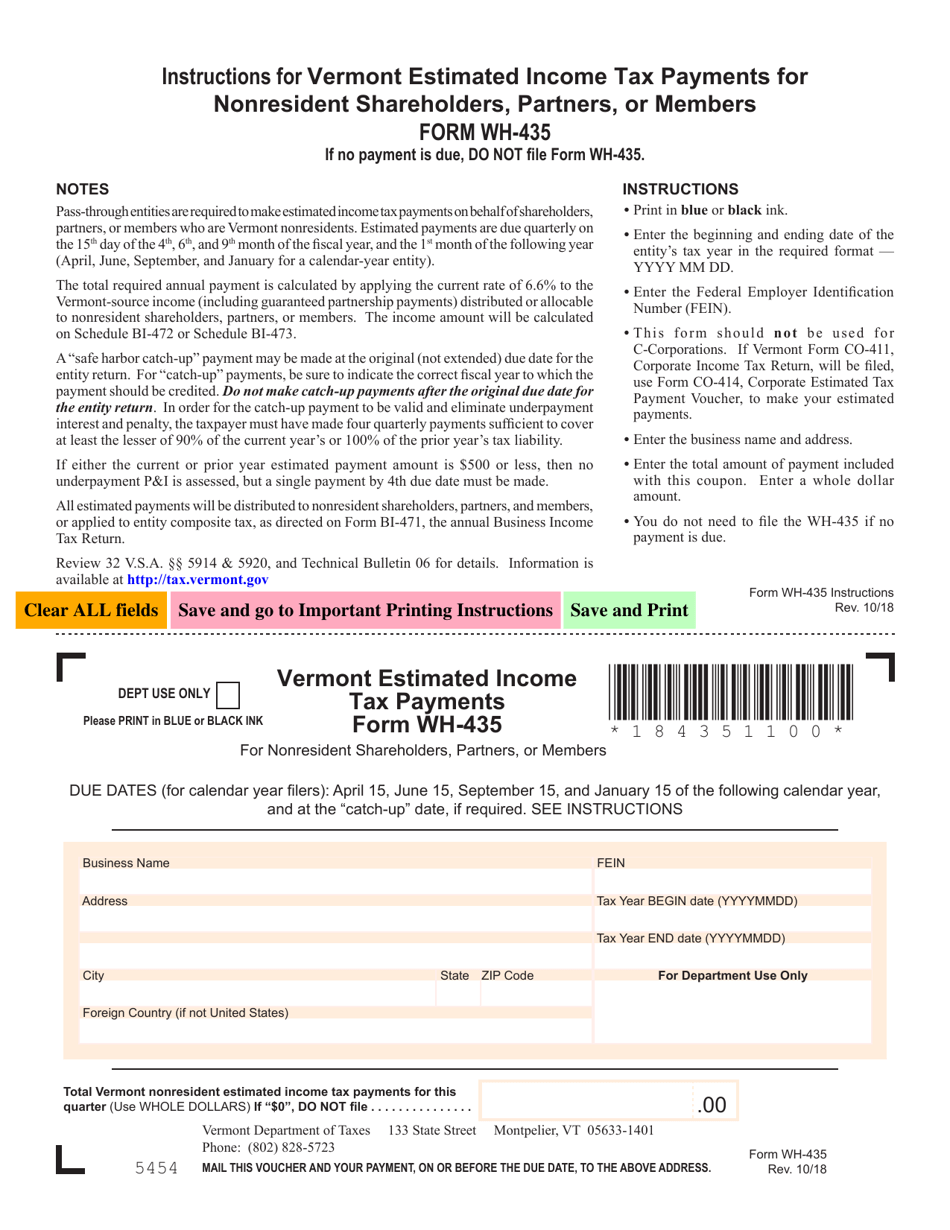

VT Form WH435 Download Fillable PDF or Fill Online Estimated

Does Vermont Have An Income Tax § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. the vermont income tax. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Property taxes are high when compared. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. taxable income is defined in 32 v.s.a. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. use our income tax calculator to find out what your take home pay will be in vermont for the tax year.

From www.townofcraftsbury.com

Vermont Tax Information — Town of Craftsbury Does Vermont Have An Income Tax vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. the vermont income tax. use our income tax calculator to find out what your take home pay will. Does Vermont Have An Income Tax.

From www.formsbank.com

Form In111 Vermont Tax Return 2004 printable pdf download Does Vermont Have An Income Tax Property taxes are high when compared. the vermont income tax. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. taxable income is defined in 32 v.s.a. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and. Does Vermont Have An Income Tax.

From www.readkong.com

2019 VERMONT HANDBOOK ON TAX MODERNIZED EFILE (MEF) FOR 2018 Does Vermont Have An Income Tax the vermont income tax. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. taxable income is defined in 32 v.s.a. use our income tax calculator to find out what your take home pay will be in vermont for the tax year. vermont has a graduated state individual. Does Vermont Have An Income Tax.

From hanneloregamboa.blogspot.com

vermont tax refund Hannelore Gamboa Does Vermont Have An Income Tax Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. use our income tax calculator to find out what your take home pay will be in vermont for the tax year. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local. Does Vermont Have An Income Tax.

From www.templateroller.com

2022 Vermont Annualized Installment Method for Underpayment of Does Vermont Have An Income Tax vermont has four income tax brackets, and the state still taxes social security benefits for some filers. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. use. Does Vermont Have An Income Tax.

From www.formsbank.com

Form Bi471 Vermont Business Tax Return 2013 printable pdf Does Vermont Have An Income Tax § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. the vermont income tax. Property taxes are high when compared. taxable income is defined in 32 v.s.a. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. vermont’s tax system consists of a state personal. Does Vermont Have An Income Tax.

From www.templateroller.com

VT Form IN114 Download Fillable PDF or Fill Online Vermont Individual Does Vermont Have An Income Tax Property taxes are high when compared. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. § 5811 (21) as federal taxable income reduced by the. Does Vermont Have An Income Tax.

From www.formsbank.com

Fillable Schedule In119 Vermont Economic Incentive Tax Does Vermont Have An Income Tax the vermont income tax. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. taxable income is defined in 32 v.s.a. use our. Does Vermont Have An Income Tax.

From www.formsbank.com

Form In111 Vermont Tax Return 2012 printable pdf download Does Vermont Have An Income Tax income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. Property taxes are high when compared. taxable income is defined in 32 v.s.a. vermont has a graduated state individual income tax, with rates. Does Vermont Have An Income Tax.

From www.formsbank.com

Instructions For Schedule In119 Vermont Economic Incentive Does Vermont Have An Income Tax income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. taxable income is defined in 32 v.s.a. Property taxes are high when compared. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. vermont’s tax system consists of a. Does Vermont Have An Income Tax.

From www.formsbank.com

Form 8879Vt Vermont Individual Tax Declaration For Electronic Does Vermont Have An Income Tax vermont has four income tax brackets, and the state still taxes social security benefits for some filers. use our income tax calculator to find out what your take home pay will be in vermont for the tax year. the vermont income tax. taxable income is defined in 32 v.s.a. vermont’s tax system consists of a. Does Vermont Have An Income Tax.

From www.formsbank.com

Form Bi471 Vermont Business Tax Return 2003 printable pdf Does Vermont Have An Income Tax taxable income is defined in 32 v.s.a. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. use. Does Vermont Have An Income Tax.

From www.scribd.com

Woolf Vermont Earned Tax Credit Does Vermont Have An Income Tax vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. use our income tax calculator to find out what. Does Vermont Have An Income Tax.

From www.templateroller.com

Form IN111 Download Fillable PDF or Fill Online Vermont Tax Does Vermont Have An Income Tax vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. the vermont income tax. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. use our income tax calculator to find out what your take home pay will. Does Vermont Have An Income Tax.

From www.formsbank.com

Fillable Schedule In154 Vermont State / Local Tax Addback Does Vermont Have An Income Tax vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. § 5811 (21) as federal taxable income reduced by the vermont standard deduction and. vermont has four income tax brackets,. Does Vermont Have An Income Tax.

From vermontbiz.com

Vermont’s overall tax system helps to lessen inequality Does Vermont Have An Income Tax vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property tax, local sales taxes and a number of. vermont has four income tax brackets, and the state still taxes social security benefits for some filers. the vermont income tax. vermont has a graduated state individual income tax, with rates. Does Vermont Have An Income Tax.

From www.pdffiller.com

Fillable Online Vermont Taxes and VT State Tax Forms eFile Fax Does Vermont Have An Income Tax income tax is imposed on vermont taxable income, which is defined as the gross income from an individual where standard. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. taxable income is defined in 32 v.s.a. § 5811 (21) as federal taxable income reduced by the vermont standard deduction. Does Vermont Have An Income Tax.

From www.pinterest.com

Chart 4 Vermont Local Tax Burden by County FY 2015.JPG Vermont Does Vermont Have An Income Tax Vermont collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. vermont has a graduated state individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Property taxes are high when compared. vermont’s tax system consists of a state personal income tax, estate tax, state sales tax, local property. Does Vermont Have An Income Tax.